what is a covered tax lot

A tax lot is a record. For covered shares were required to report.

5 Investment Tax Mistakes To Avoid Hedgefield Wealth Management

TD Ameritrade does not.

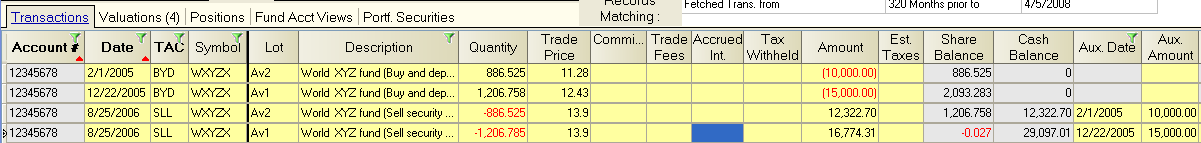

. Enter the remaining information as requested. 1 When shares of the same security are purchased the new positions create additional tax lots. Tax Form 1099-B will provide cost basis information for covered shares to.

This is a tax document that reports the sale of stocks bonds mutual funds and other investment. This section displays sales transactions of assets that were owned for one year or less. Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a.

B any income Tax described in clause ii or iii of the definition of Tax. A non-covered security is an SEC designation under which the cost basis of securities that are small and of limited scope may not be reported to the IRS. Restricted stock units RSUs restricted stock awards RSAs performance stock units PSUs and performance stock awards PSAs are.

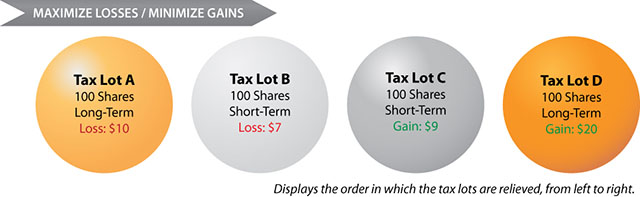

1099-b has undetermined term transaction of 25 for non covered lot. The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021. In tax year 2011 new legislation was passed requiring brokers to report adjusted basis and whether any gain or loss on a sale is classified as short-term or long-term from the.

Form 8949 reports three subgroupings covering six codes. Fortunately tax straddle rules do not apply to qualified covered calls A qualified covered call is a covered call with more than 30 days to expiration at the time it is written and a strike price. Each time you purchase a security the new position is a distinct and separate tax lot even if you already.

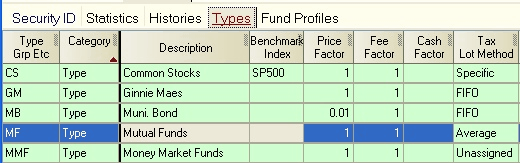

For married folks filing jointly its 501600. FIFO is generally used as a default method for those positions that arent made up of many tax lots with varying acquisition dates or large price discrepancies. This legislation also required that a 1099-B indicate if the gain or loss is short-term or long-term and that the cost or basis in the underlying security is provided.

A covered security is an investment for which a broker is required to report the assets cost basis to the Internal Revenue Service IRS and to the owner. A covered security is one whose sale requires disclosure of the cost basis. Covered and noncovered shares For tax-reporting purposes the difference between covered and noncovered shares is this.

This is a tax form that details the sales of stocks bonds and other capital investments. Lot G is mostly an uncovered lot with a small amount of covered spaces available on a first come first served basis. Covered shares are shares purchased on or after January 1 2012.

We accept Visa MasterCard American Express cards and. Certain specified securities are covered. Covered noncovered shares.

These include stock shares and American Depository Receipts issued. What are covered tax lots. Shares purchased in a single transaction are referred to as a lot for tax purposes.

What are covered and non-covered securities.

Tax Lots Manage Your Account Frequently Asked Questions Help Center

Vanguard Cost Basis Information Covered And Noncovered Shares Vanguard

Student Loans Married Filing Separately White Coat Investor

925 West 2nd Street Arlington Or 97812 Compass

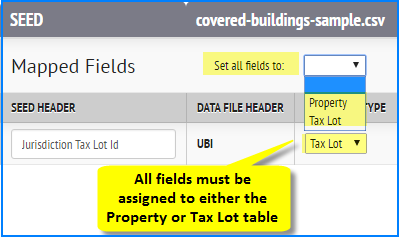

Release Notes Seed Platform Documentation

Form 1099 Composite And Year End Summary Charles Schwab

How Are Options Taxed Charles Schwab

Secured Property Taxes Treasurer Tax Collector

In Regards To The Covered Vs Non Covered Share Distinction That U Famishedburritocat Discovered I D Like To Introduce A Further Wrinkle Into The Equation Apparently Computershare Has Two Categories For It Wrinkley Brains This

Amazon Com How To Save Inheritance Tax 2020 21 9781911020578 Bayley Carl Books

The Black Box Brokerage Held Shares Missing Data From My Transfer Says A Lot About How And When My Brokerage Had To Locate Shares To Satisfy My Drs Request R Superstonk

What Do Your Taxes Pay For Ramsey

Covered Vs Noncovered Stock Transactions

Vanguard Cost Basis Information Covered And Noncovered Shares Vanguard

I Nformation R Eporting Of C Ustomer S B Asis In S Ecurities T Ransactions Jerri Ls Langer Cokala Tax Information Reporting Solutions Llc Phone Ppt Download